Understanding Origination Fees vs. Interest Rate Points on Your Mortgage Loan

When you’re securing a mortgage loan, it’s essential to understand the various costs involved. Two common terms you’ll encounter are origination fees and interest rate points. Let’s break down what each of these means and how they impact your loan.

ORIGINATION FEES

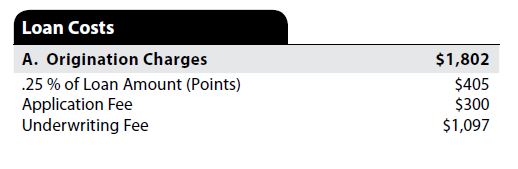

What Are They? Origination fees are charged by the lender for processing your loan application. These are charged to all borrowers. These fees cover the administrative costs of underwriting and funding the loan.

How Much Are They? They can range from flat fees or a percentage of your loan amount. They will vary widely by lender and could be up to 1% of the loan amount. For example, on a $300,000 loan, a 1% origination fee would be $3,000.

When Are They Paid? These fees are usually paid at closing and are part of your closing costs.

Why Are They Important? Origination fees can vary between lenders, so it’s crucial to compare these fees when shopping for a mortgage. Lower origination fees can reduce your upfront costs. Origination fees are found in Section A of your Loan Estimate as shown below.

INTEREST RATE POINTS (DISCOUNT POINTS)

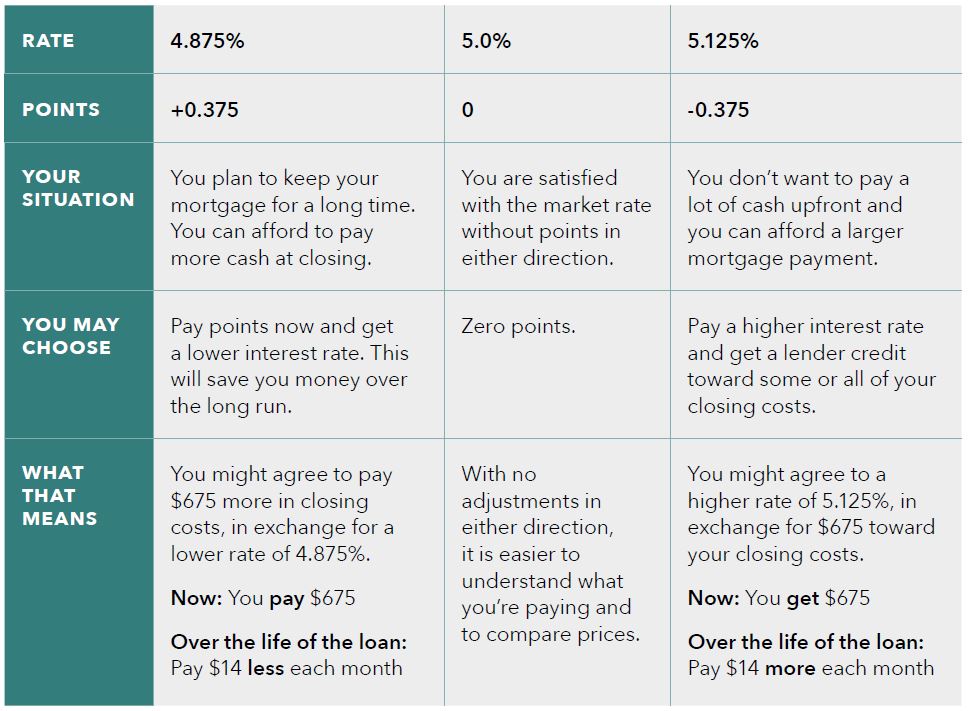

What Are They? Interest rate points, also known as discount points, are optional fees you can pay to lower your mortgage interest rate. One point equals 1% of the loan amount.

How Much Are They? These vary widely based on the rates available the day you intend to lock. One example would be if you planned on borrowing $300,000 over 30 years and you intended to buy 1% point to reduce your rate by 0.25%. By paying 1% point ($3,000), your interest rate might drop from 5.75% to 5.5%. In this scenario the principle and interest payment would be reduced by $47 a month over the term of the loan (30 years or 360 months).

When Are They Paid? Points are paid at closing, along with other closing costs.

Why Are They Important? Paying points can save you money over the life of the loan by reducing your monthly payments. However, it requires a higher upfront cost. It’s essential to calculate whether the long-term savings justify the initial expense. Below is an example of loan with paid points, no paid points and a lender credit option.

Key Differences

- Purpose: Origination fees cover the lender’s administrative costs, while points are optional fees to reduce your interest rate.

- Impact on Loan: Origination fees increase your upfront costs without affecting your interest rate. Points increase your upfront costs but lower your interest rate and monthly payments.

- Flexibility: Origination fees are generally non-negotiable, whereas you can choose whether or not to pay points based on your financial situation and long-term plans.

OTHER FEES

Appraisal Fee: The appraisal fee covers the cost of having a professional appraiser evaluate the value of the property you are purchasing. Appraisal fees typically range from $300 to $1500. These are paid directly to the appraiser or appraisal management company (AMC). Lenders require an appraisal to ensure the property’s value supports the loan amount. This protects the lender in case of default and confirms the sales price is supported during a purchase transaction.

Title Search and Title Insurance Fees: Title search fees cover the cost of researching the property’s history to ensure there are no legal issues, such as unpaid taxes or liens. Title insurance protects both the lender and the borrower against future claims on the property. Title search fees can range from $200 to $400, while title insurance can cost around 0.5% to 1% of the loan amount. These fees ensure that the property has a clear title, protecting both you and the lender from potential legal disputes.

Closing Costs: Closing costs encompass various fees, including attorney fees, recording fees, and prepaid costs like property taxes and homeowners’ insurance. Closing costs generally range from 2% to 5% of the loan amount. These fees cover the final administrative and legal steps required to complete the mortgage transaction.

Understanding the various fees associated with your mortgage loan application can help you better prepare for the costs involved in securing a home loan. Always ask your lender for a detailed breakdown of these fees and compare offers from multiple lenders to ensure you’re getting the best deal. Being informed can help you navigate the mortgage process more confidently and potentially save money.